Comparative Costs: Owning vs Renting vs Leasing a Car in Oman

Comparative Costs: Owning vs Renting vs Leasing a Car in Oman (2025 Analysis)

By OmanWheels Research Desk – Updated November 2025

With Oman’s automotive ecosystem evolving rapidly, many residents, expatriates, and even frequent tourists are reconsidering how best to get behind the wheel — should they own, rent, or lease a car? The answer depends on your lifestyle, length of stay, and financial outlook. This report dissects each option with real market data for 2025 to help you make a financially smart choice. Used Commercial Vehicles on the Rise in Oman 2025.

Understanding the 2025 Automotive Market in Oman

The Omani car market has matured with increased transparency in financing, insurance, and rental services. With Vision 2040 infrastructure projects boosting road quality and mobility, demand patterns are shifting — not just for vehicles but for ownership models themselves.

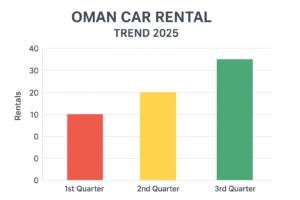

In Muscat and Sohar, car rental and leasing agencies have reported double-digit growth, while ownership remains strong in the interior governorates due to longer commutes and fewer short-term rental outlets.

Option 1: Owning a Car in Oman

Ownership remains the most popular choice among residents planning to stay for over three years. It provides full control and long-term cost efficiency, but comes with depreciation risks and maintenance expenses.

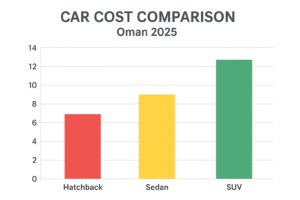

Typical Costs for Ownership (Annualized – 2025 Estimates)

| Cost Component | Average Annual Cost (OMR) | Notes |

|---|---|---|

| Depreciation | 1,200 | Varies by model; SUVs lose ~15% per year |

| Insurance | 250–400 | Comprehensive policies preferred |

| Fuel | 600–900 | Based on 15,000 km annually |

| Servicing & Maintenance | 300–600 | Dealership or independent garage |

| Registration & Misc. | 50–100 | ROP annual registration |

Total Ownership Cost (per year): Approximately OMR 2,400 – 3,000

Pros

- Full ownership and resale value

- Freedom to customize or modify

- Better for long-term stays

Cons

- High upfront cost and depreciation

- Maintenance responsibility

- Lower liquidity if you plan to relocate

Option 2: Renting a Car in Oman

For expatriates on short-term contracts or tourists visiting during peak travel seasons like Khareef Salalah, renting is often the easiest and most flexible choice. However, the convenience comes at a premium.

Typical Monthly Rental Rates (2025)

| Vehicle Type | Average Daily Rate (OMR) | Monthly Rate (OMR) |

|---|---|---|

| Sedan (e.g., Toyota Corolla) | 12–15 | 350–400 |

| SUV / 4×4 | 18–25 | 500–650 |

| Luxury SUV | 40–60 | 1,200+ |

Rental Pros:

- Zero maintenance or registration cost

- Easy vehicle change options

- 24/7 roadside assistance in most packages

Rental Cons:

- More expensive for long durations

- Limited mileage in many contracts

- No resale or ownership benefit

Option 3: Leasing a Car in Oman

Car leasing is gaining traction among corporate clients and salaried expatriates. It bridges the gap between renting and owning — providing use without the full cost of ownership.

Average 3-Year Lease Cost Comparison (2025)

| Category | Monthly Lease (OMR) | Coverage |

|---|---|---|

| Economy | 180–220 | Insurance + maintenance |

| Mid-Range Sedan | 250–300 | Full-service lease |

| SUV / Crossover | 350–450 | Comprehensive lease plan |

Leasing Pros:

- Predictable monthly cost

- Option to upgrade every few years

- Maintenance included

Leasing Cons:

- No equity or resale value

- Early termination penalties

- Limited customization

Which Option Makes the Most Sense in Oman (2025)?

For expatriates on short-term contracts, renting remains the most practical due to flexibility. Long-term residents should consider ownership for cost efficiency and resale value. Leasing is ideal for corporate or executive professionals who value convenience over ownership.

Regional Insight:

- Muscat: Leasing and renting dominate due to urban convenience.

- Dhofar: Ownership preferred for long-distance and off-road use.

- Interior Regions: Used ownership models prevail for affordability.

Conclusion

In 2025, Oman’s auto users have more choices than ever before. Whether it’s renting for flexibility, leasing for convenience, or owning for long-term savings, the market offers options tailored to every budget and lifestyle. The key is to factor in total cost of ownership — fuel, insurance, depreciation, and resale — before signing the next car agreement.

Source: OmanWheels Automotive Cost Study 2025

Related Post

Tips & Guides for Car Owners in Oman 2025 | Maintenance, Resale & Buying Used Cars

Tips & Guides for Car Owners in Oman (Maintenance, Resale, Buying Used, and More) By [...]Car Showroom Supervisor Required

🚘 Car Showroom Supervisor Full-time | Immediate Hiring Alseeb 100 – 300 OMR Full Time [...]