Car‑Loan and Finance Innovations in Oman 2025 – Tailored Products for Freelancers, Women Buyers and the Self‑Employed | EV Adoption in Oman 2025

Car‑Loan and Finance Innovations in Oman

In 2025, Oman’s automotive financing landscape is experiencing a rapid transition driven by digital applications, the evolving used-car market in Oman, rising EV adoption in Oman 2025, and a growing population of freelancers and independent professionals. New lending products are emerging to support groups that traditionally faced challenges: freelancers, women drivers, and self-employed micro-entrepreneurs. This report-style article explores the major innovations, lender strategies, updated banking policies, and market projections shaping automotive finance in Oman.

1. Overview: Why Automotive Finance Is Changing in Oman

The automotive sector in Oman has historically relied on traditional salary-based financing. However, the shift to a flexible workforce, coupled with the growth of digital car-buying Oman platforms, is pushing banks and fintech providers to redesign loan products. In 2025, over 36% of new applications in urban areas were submitted online, while women and freelancers represented the fastest-growing applicant segment.

Key Drivers in 2025

- Growth of app-based freelance platforms (delivery riders, consultants, creatives).

- Increasing participation of women in personal and commercial driving.

- Strong recovery in the used-car market Oman with demand up nearly 18% year-on-year.

- Renewed national push to support EV adoption in Oman 2025 under sustainability initiatives.

- Digital-first lending from banks and auto marketplaces.

2. New Car‑Loan Models Tailored for Freelancers and Self-Employed Buyers

Freelancers have traditionally struggled to secure car loans due to irregular income and lack of formal salary slips. In 2025, however, banks are rolling out new underwriting models. New Loan Schemes 2025.

2.1 Income-Averaging Car Loans

Instead of requiring monthly salary statements, lenders now accept:

- Bank statements showing 6–12 months of income inflow

- E‑commerce earnings screenshots

- Delivery app payout summaries

- POS/QR transaction histories for micro‑businesses

2.2 Flex‑EMI (Seasonal Payment) Options

Designed for photographers, consultants, event freelancers and tourism‑based workers, Tourism Driven Rental Car Demand in Oman 2025. Flex EMI allows customers to reduce instalments during off‑season and increase during peak seasons.

2.3 Micro‑Commercial Vehicle Loans

These apply to delivery drivers, freelancers using vans, and female entrepreneurs launching home‑business fleets. Approvals are faster with alternative credit scoring.

3. Finance Innovations for Women Drivers in Oman

2024–2025 saw a 29% jump in car applications from women, especially first‑time buyers. Banks and dealer networks are creating specialized offers.

3.1 Women‑Only Preferential Interest Rates

Several banks offer 0.5%–1% reduced rates for women, paired with:

- Lower salary requirement (as low as OMR 250)

- Dedicated customer‑support lines

- Bundled insurance with roadside assistance

3.2 EV Incentives for Women and Families

To promote EV adoption in Oman 2025, lenders give additional rebates such as:

- Grace period of 60–90 days

- Free home-charger installation

- Extended 8-year battery warranty

4. Digital Car-Buying Oman: How Online Platforms Accelerate Loan Approvals

Digitalization is transforming how buyers compare loan offers and complete applications in minutes.

4.1 AI-Based Eligibility Calculators

Platforms now auto-calculate eligibility for freelancers and women according to updated underwriting rules.

4.2 Same‑Day Approval for Used Cars

The used‑car market Oman has benefited from simplified inspection reports and instant vehicle‑history uploads.

4.3 Digitally Verified Income for Freelancers

Instead of paperwork, apps sync with bank accounts or wallet applications to verify earnings.

5. Market Data Snapshot (2025)

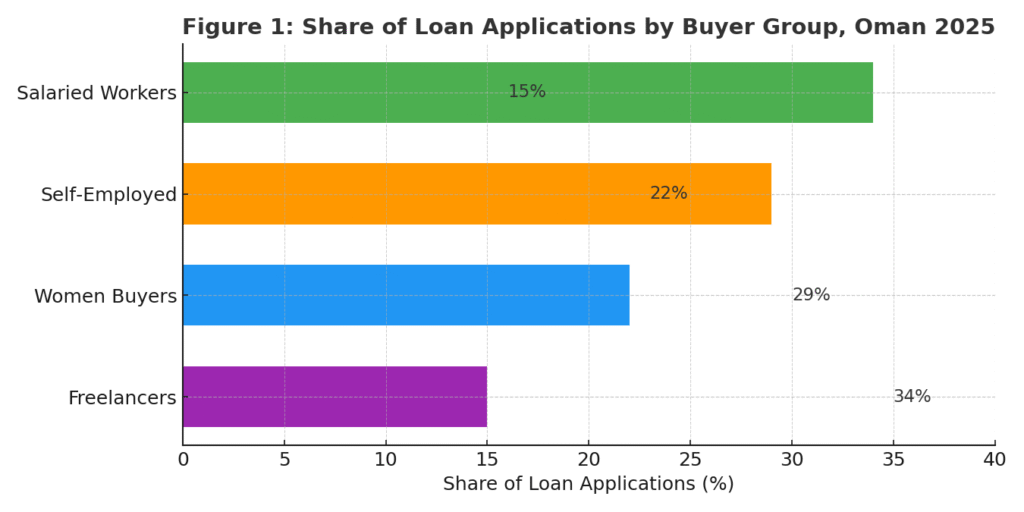

The following figure summarises the shift in loan categories applied for by various buyer groups in Oman.Figure 1: Share of Loan Applications by Buyer Group, Oman 2025

6. EV Adoption in Oman 2025: Finance Products Supporting Electric Vehicles

Oman is pushing toward sustainable mobility. EV‑friendly financing models include:

- 0% interest for the first year

- Battery leasing instead of full vehicle financing

- Extended 10-year repayment terms

- Insurance discounts for EV users

6.1 EV vs Petrol: Cost Comparison Table

| Category | EV (2025) | Petrol Car (2025) |

|---|---|---|

| Average Monthly EMI | OMR 135 | OMR 160 |

| Annual Fuel/Energy Cost | OMR 120 | OMR 480 |

| Service & Maintenance | OMR 70 | OMR 220 |

| Government Incentives | Home charger, rebates | None |

7. Used-Car Market Oman: Finance Trends in 2025

The used-car sector remains strong due to affordability, availability of Japanese imports, and digital inspection systems.

7.1 Growth Drivers

- Price-sensitive buyers post-inflation

- Easy online pre-approval

- Financing available for cars up to 8–10 years old

- Lower down-payment requirements

7.2 Popular Used-Car Loan Models

- Low down-payment (5–10%)

- High-mileage financing

- Financing for women-led businesses and freelancers

8. Challenges Still Faced by Freelancers and Women Buyers

Despite progress, issues remain:

- Lenders still request guarantors for low-income freelancers

- Used EVs have limited financing options

- Insurance for women-owned commercial fleets remains costly

9. 2025 Outlook: The Future of Car Finance in Oman

By the end of 2025, Oman’s lenders are expected to launch fully digital loan journeys and AI-based risk scores. EV‑oriented financing will expand, and new Sharia‑compliant leasing packages will target freelancers, women entrepreneurs, and family-run businesses. The rise of digital car-buying Oman will continue to push innovation across automotive finance.

Conclusion: Oman’s car-loan ecosystem is shifting toward inclusivity, especially for freelancers, women buyers, and self-employed professionals. As digital systems mature and the used-car market Oman expands, these innovations will make vehicle ownership more accessible and sustainable in the years ahead.

Car‑Loan and Finance Innovations in Oman 2025 – Tailored Products for Freelancers, Women Buyers and the Self‑Employed | EV Adoption in Oman 2025

Car‑Loan and Finance Innovations in Oman: Tailored Products for Freelancers, Women Buyers, and the Self‑Employed (2025 Update)

In 2025, Oman’s automotive financing landscape is experiencing a rapid transition driven by digital applications, the evolving used-car market in Oman, rising EV adoption in Oman 2025, and a growing population of freelancers and independent professionals. New lending products are emerging to support groups that traditionally faced challenges: freelancers, women drivers, and self-employed micro-entrepreneurs. This report-style article explores the major innovations, lender strategies, updated banking policies, and market projections shaping automotive finance in Oman.

1. Overview: Why Automotive Finance Is Changing in Oman

The automotive sector in Oman has historically relied on traditional salary-based financing. However, the shift to a flexible workforce, coupled with the growth of digital car-buying Oman platforms, is pushing banks and fintech providers to redesign loan products. In 2025, over 36% of new applications in urban areas were submitted online, while women and freelancers represented the fastest-growing applicant segment.

Key Drivers in 2025

- Growth of app-based freelance platforms (delivery riders, consultants, creatives).

- Increasing participation of women in personal and commercial driving.

- Strong recovery in the used-car market Oman with demand up nearly 18% year-on-year.

- Renewed national push to support EV adoption in Oman 2025 under sustainability initiatives.

- Digital-first lending from banks and auto marketplaces.

2. New Car‑Loan Models Tailored for Freelancers and Self-Employed Buyers

Freelancers have traditionally struggled to secure car loans due to irregular income and lack of formal salary slips. In 2025, however, banks are rolling out new underwriting models.

2.1 Income-Averaging Car Loans

Instead of requiring monthly salary statements, lenders now accept:

- Bank statements showing 6–12 months of income inflow

- E‑commerce earnings screenshots

- Delivery app payout summaries

- POS/QR transaction histories for micro‑businesses

2.2 Flex‑EMI (Seasonal Payment) Options

Designed for photographers, consultants, event freelancers and tourism‑based workers, Flex EMI allows customers to reduce instalments during off‑season and increase during peak seasons.

2.3 Micro‑Commercial Vehicle Loans

These apply to delivery drivers, freelancers using vans, and female entrepreneurs launching home‑business fleets. Approvals are faster with alternative credit scoring.

3. Finance Innovations for Women Drivers in Oman

2024–2025 saw a 29% jump in car applications from women, especially first‑time buyers. Banks and dealer networks are creating specialized offers.

3.1 Women‑Only Preferential Interest Rates

Several banks offer 0.5%–1% reduced rates for women, paired with:

- Lower salary requirement (as low as OMR 250)

- Dedicated customer‑support lines

- Bundled insurance with roadside assistance

3.2 EV Incentives for Women and Families

To promote EV adoption in Oman 2025, lenders give additional rebates such as:

- Grace period of 60–90 days

- Free home-charger installation

- Extended 8-year battery warranty

4. Digital Car-Buying Oman: How Online Platforms Accelerate Loan Approvals

Digitalization is transforming how buyers compare loan offers and complete applications in minutes.

4.1 AI-Based Eligibility Calculators

Platforms now auto-calculate eligibility for freelancers and women according to updated underwriting rules.

4.2 Same‑Day Approval for Used Cars

The used‑car market Oman has benefited from simplified inspection reports and instant vehicle‑history uploads.

4.3 Digitally Verified Income for Freelancers

Instead of paperwork, apps sync with bank accounts or wallet applications to verify earnings.

5. Market Data Snapshot (2025)

The following figure summarises the shift in loan categories applied for by various buyer groups in Oman.Figure 1: Share of Loan Applications by Buyer Group, Oman 2025

Freelancers – 34%

Women Buyers – 29%

Self‑Employed – 22%

Salaried Workers – 15%

6. EV Adoption in Oman 2025: Finance Products Supporting Electric Vehicles

Oman is pushing toward sustainable mobility. EV‑friendly financing models include:

- 0% interest for the first year

- Battery leasing instead of full vehicle financing

- Extended 10-year repayment terms

- Insurance discounts for EV users

6.1 EV vs Petrol: Cost Comparison Table

| Category | EV (2025) | Petrol Car (2025) |

|---|---|---|

| Average Monthly EMI | OMR 135 | OMR 160 |

| Annual Fuel/Energy Cost | OMR 120 | OMR 480 |

| Service & Maintenance | OMR 70 | OMR 220 |

| Government Incentives | Home charger, rebates | None |

7. Used-Car Market Oman: Finance Trends in 2025

The used-car sector remains strong due to affordability, availability of Japanese imports, and digital inspection systems.

7.1 Growth Drivers

- Price-sensitive buyers post-inflation

- Easy online pre-approval

- Financing available for cars up to 8–10 years old

- Lower down-payment requirements

7.2 Popular Used-Car Loan Models

- Low down-payment (5–10%)

- High-mileage financing

- Financing for women-led businesses and freelancers

8. Challenges Still Faced by Freelancers and Women Buyers

Despite progress, issues remain:

- Lenders still request guarantors for low-income freelancers

- Used EVs have limited financing options

- Insurance for women-owned commercial fleets remains costly

9. 2025 Outlook: The Future of Car Finance in Oman

By the end of 2025, Oman’s lenders are expected to launch fully digital loan journeys and AI-based risk scores. EV‑oriented financing will expand, and new Sharia‑compliant leasing packages will target freelancers, women entrepreneurs, and family-run businesses. The rise of digital car-buying Oman will continue to push innovation across automotive finance.

Conclusion: Oman’s car-loan ecosystem is shifting toward inclusivity, especially for freelancers, women buyers, and self-employed professionals. As digital systems mature and the used-car market Oman expands, these innovations will make vehicle ownership more accessible and sustainable in the years ahead.